Bibliometric analysis of journals, authors, and topics related to COVID-19 and Islamic finance listed in the Dimensions database by Biblioshiny

Article information

Abstract

Purpose

This bibliometric study investigated the current state of documents on coronavirus disease 2019 (COVID-19) and Islamic finance published by digital object identifierequipped journals listed in the Dimensions database. The analysis focused on describing the characterictics and trends of the keywords, authors, and journals.

Methods

The data analyzed were from 149 research publications in Dimensions. The search tems were “COVID” and “Islamic finance.” The searches used to establish the study dataset were last updated on August 27, 2020. Descriptive statistical methods were used, and a bibliometric analysis was conducted using Biblioshiny, an R-based app, to generate a bibliometric map.

Results

The number of articles discussing the theme of COVID-19 and Islamic finance was quite large in recent months, with more than 100 articles published. The most popular keywords used were “COVID,” “food,” and “pandemic,” although there were also many keywords that related more specifically to the field of Islamic finance, namely “banks,” “markets,” “health,” “debt,” “equity,” “management,” and “stock.”

Conclusion

This study provides an overview of trends in the most popular keywords, journals, and authors of articles on the topic of COVID-19 and Islamic finance, which has been quite a popular theme in recent months, thereby providing information for researchers specializing in the field of Islamic finance. This theme has the potential to continue to be developed.

Introduction

Background/rationale: Currently, the entire world is facing a prolonged crisis due to the coronavirus disease (COVID-19) pandemic, which emerged at the end of 2019. The virus has resulted in severe economic damage [1]. The attention of countries throughout the world has shifted from the problem of the spread of the disease to focus on the negative economic and financial consequences of the pandemic for nations and their people; for example, production shortages will have impacts on supply chains and result in many layoffs and a lack of employment for millions of people around the world [2]. However, Islamic social finance can serve as an instrument to maintain a country’s economic activity. This instrument merits further attention by all levels of society considering its importance in providing spiritual impacts (worship), social impacts (mutual aid/assistance), and economic impacts (income distribution). The importance of the economy during this pandemic underscores the fact that social inequality and inequalities in people’s income are the sources of a broad range of urgent problems requiring improvement [3].

Objectives: The analysis focused on describing the keywords, authors, journals, and characteristics of articles on COVID-19 and Islamic finance retrieved from the Dimensions database (https://www.dimensions.ai/). Papers on this topic are interesting to discuss considering the importance of scientific research for generating ideas and innovations in response to economic problems.

Methods

Ethics statement: This research did not involve human subjects. Therefore, neither institutional review board approval nor informed consent was needed.

Study design: This was a literature-based descriptive study involving a bibliometric analysis.

Setting: This study used publication data related to COVID-19 and Islamic finance sourced from the Dimensions database. The Dimensions database is an alternative indexation with the criterion that all articles have a specific DOI. The search terms were “COVID” AND “Islamic finance” in the full data. This search was conducted on August 23, 2020, and yielded 237 publications, of which 149 published articles were related to the issue of COVID-19 and Islamic finance (Dataset 1). Data on keywords, authors, journals, and the characteristics of these documents on the role of Islamic finance during the COVID-19 pandemic were analyzed using the R-based Biblioshiny app, which is freely available from: https://bibliometrix.org/.

Statistical methods: Descriptive data are presented as numbers, percentages, and rankings. Descriptive statistical analyses were carried out to present the timeline and distribution of the articles.

Results

Publication types of sources

The 149 publications consisted of five different types: 87 journal articles (58.3%), 12 book chapters (8.1%), two monographs (1.3%), and 48 preprint (manuscript deposited on public repository before peer review) studies or studies uploaded before peer review (32.2%).

Three fields plot

The three fields plot shown below is an illustration of three elements, consisting of a list of journal names, authors, and topics (Fig. 1). These three elements are plotted with gray linkages that show their relationship with each other, starting from the name of the journal, followed by the author, and each author is then linked to the topic of their publication. The size of each rectangle in each list indicates the number of papers associated with that element.

The first element, on the left, is the journal. Seven journals were indexed in the three fields plot as having published papers on the topic of COVID-19 and Islamic finance, and the top journal that published the most papers on this topic was the SSRN Electronic Journal, which is depicted with a blue rectangle and connected to several authors, namely Khan, Fahad, Faizal, Naushad, Akbar, Goodell, Taskinsoy, Ashraf, Rizwan, Yarovaya, Ahmad, Corbet, Harcon, Rizvi, Wang, and Tarazi.

The second element in the middle contains authors’ names. Authors who published articles in journals that were recognized are associated with previous elements, such as Tarazi A, who is linked to the SSRN Electronic Journal and the Global Finance Journal as journal elements. However, some others did not publish in indexed journals, and therefore do not have any connection with any of the journals listed, such as Un U and Salisu AA. Each of the authors is also associated with frequently used keyword topics on the right. The 19 top authors are listed in this plot. The size of the rectangle shows the number of papers written by each author. In this plot, Khan, Fahad, Faizal, and Naushad had the largest rectangles (of equal size). The third element contains the topic-related keywords that appeared most frequently in the papers. Each topic is associated with authors who published extensively on that topic. Sixteen keyword topics are listed, and the keyword that appeared most frequently was “COVID,” as indicated by the size of the red rectangle, which dominated the other rectangles. It also appeared that the topic of COVID was used by almost all of the registered authors, which aligns with the focus of this research on scientific papers related to COVID-19 and Islamic finance. In addition to COVID, this plot also shows several other keywords that were widely used, such as “economy” and “pandemic.”

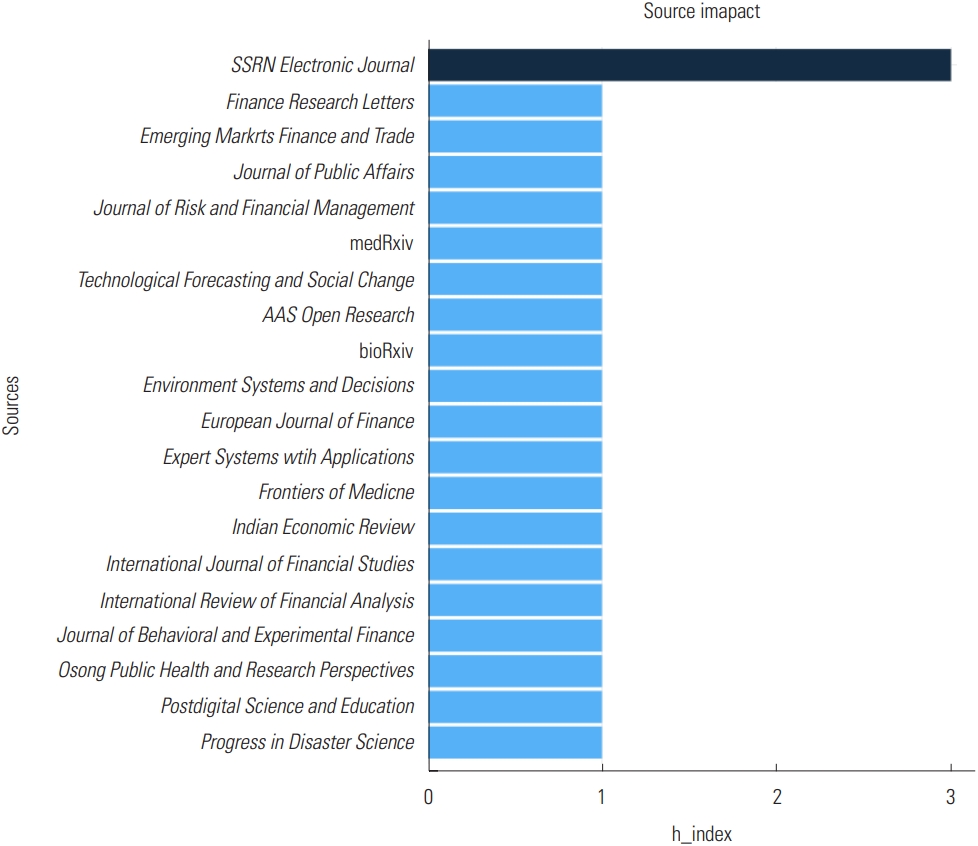

Source impact

In addition to the quantity and relevance of publications, this study also analyzed the impact of each journal that published papers on the topic of COVID-19 and Islamic finance by calculating the journal’s h-index, which is depicted in the bar chart shown in Fig. 2. Along with a numerical representation of the h-index value of each journal, this diagram also shows the impact of each journal through the shade of blue, with a darker color indicating higher-impact journals.

SSRN Electronic Journal occupied the top position in terms of impact, with an h-index of 3 and a black bar on the chart. Nineteen other journals had h-indices of 1 and are colored light blue on the diagram, indicating their relatively low impact.

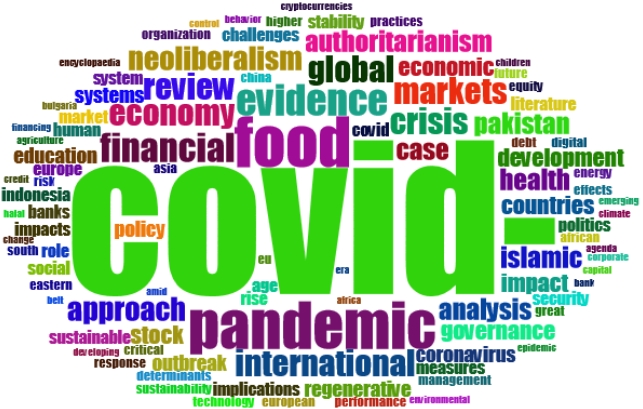

Word cloud

The word cloud in Fig. 3 presents a visualization of the words that appeared most frequently in the papers on the topic of COVID-19 and Islamic finance. The most common word was “COVID,” the second most common word was “food,” and the third most common word was “pandemic.”

Visualization of the words that appeared most frequently in the papers on the topic of COVID-19 and Islamic finance.

The word cloud displays words in various sizes according to the number of times they appear. The placement of words is somewhat random, but the predominating words are placed in the middle so that they are more visible, given their large size.

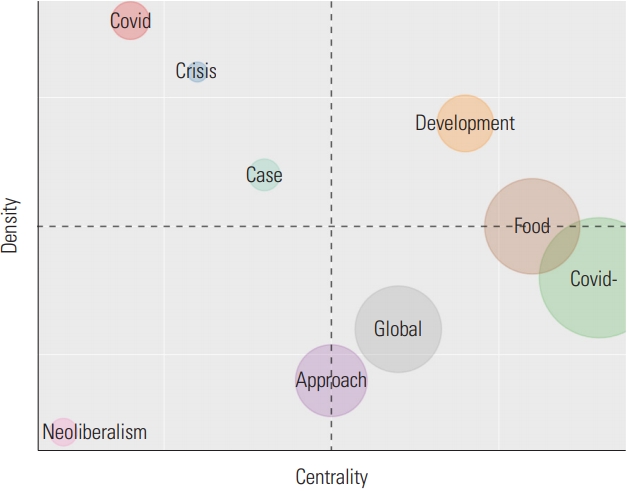

Thematic map

A thematic map was also generated based on density and centrality, divided into four topological regions (Fig. 4). This result was obtained from a semi-automatic algorithm by reviewing the titles of all references analyzed in this study and additional relevant keywords (apart from the author’s keywords) to capture deeper variations.

The upper right quadrant shows “motor” or “driving” topics, indicated by high density and centrality; these topics, which included “development” and to some extent “food,” should be developed further given their importance for future research. The quadrant in the top left shows specific and under-represented topics that nonetheless are areas of rapid development, as indicated by high density but low centrality, including “COVID,” “crisis,” and “case.”

The lower left quadrant contains topics that have been used but have experienced a downward trend, indicated by low centrality and density; this region included “neoliberalism” and, to some extent, “approach.” Finally, the lower right quadrant contains basic topics, indicated by high centrality but low density; these topics are important for research as general topics, and included “COVID-,” “global,” part of the “approach” topic, and part of the “food” topic.

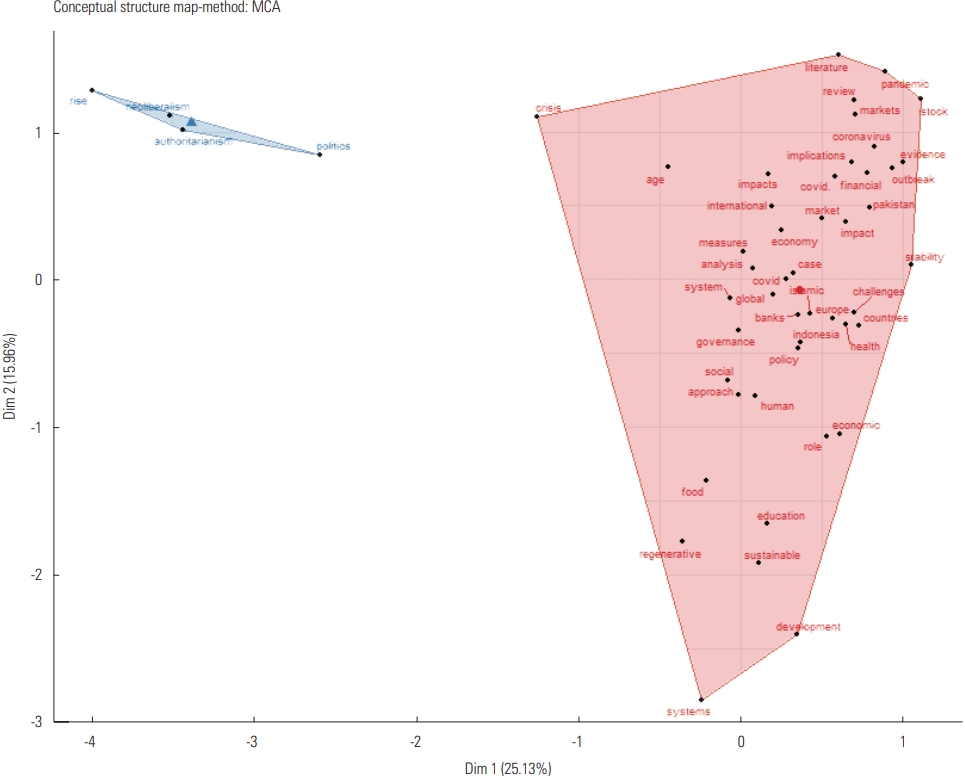

Conceptual structure map

A conceptual structure map was generated, containing a visualization of the contextual structure of each word that appeared often in research papers on the topic of COVID-19 and Islamic finance by mapping the relationship between one word and another through regional mapping (Fig. 5). Each word is placed according to the values of Dim 1 and Dim 2, Dim is Diminutive particle, which is a specific term in bibliometric science, thereby producing a mapping between words whose values did not differ to a considerable extent.

A conceptual structure map was generated, containing a visualization of the contextual structure of each word.

There are two divisions in this map: the red area and the blue area, each of which contains words that are related to each other. As shown above, the red area contained a high number and variety of words, demonstrating that that many research papers presented connections between the words listed in this region, which contained the top three words that appeared most often (“COVID,” “food,” and “pandemic”).

Discussion

Interpretation: This study presents a bibliometric analysis, conducted using the Biblioshiny app, of journal articles with a digital object identifier on the theme of COVID-19 and Islamic finance indexed by the Dimensions database. Since its global spread, COVID-19 has become a major focus of researchers’ interest, including those in the field of Islamic finance. In recent months, the literature on Islamic finance has begun to widely reflect this focus on COVID-19.

Based on the results above, it appears that research on COVID-19 and Islamic finance has been widely published by various journals and numerous authors, with a broad range of specific topics. The three fields plot, which visualized three parameters (namely journals, authors, and topics) and allowed their relationships to be analyzed, showed the topics discussed by the authors and the journals in which authors published their research. This plot also presented the quantity of each element, the journals with the most publications on the relevant topics, and the most productive writers.

The SSRN Electronic Journal was shown to be the most productive journal in the three fields plot, as it published articles by many writers on the topic of COVID-19 and Islamic finance. Interestingly, this was also the only high-impact journal, with an h-index of 3, while the other journals only had hindices of 1. Thus, SSRN Electronic Journal dominated other journals in terms of the quantity and impact of research on the theme of COVID-19 and Islamic finance, allowing it to serve as a resource for researchers who are looking for references regarding research on this theme.

The most frequently used words in articles on the theme of COVID-19 and Islamic finance included “COVID,” “pandemic,” “food,” “financial,” “international,” and “crisis.” Thus, most of the articles focused on prioritizing the topic of COVID-19, with a secondary focus on Islamic finance. As shown by the most widely used words, which included “banks,” “markets,” “health,” “debt,” “equity,” “management,” and “stock,” the discussions of Islamic finance dealt with a broad range of themes. Therefore, it can be concluded that the research on this theme was quite comprehensive and covered various sectors in Islamic finance.

Interestingly, several names of countries and regions of the world appeared in the word cloud, including Indonesia, China, Pakistan, Europe, Asia, and Bulgaria. This fact shows that several countries were frequent objects of study in research on COVID-19 and Islamic finance. This may reflect a specific focus on COVID-19, as in studies dealing with China, or a primary focus on Islamic finance in countries where this system is quite developed, such as Indonesia. Research on Islamic finance in the COVID-19 era requires a country that has implemented the Islamic financial system as an object of study, and these countries seem to be quite popular as the object of research based on the articles on COVID-19 and Islamic finance studied in this study.

The topic development shown by the thematic map provides an overview of the position of each topic in a quadrant comparing the density and centrality of the topic. The upper left quadrant and the lower right quadrant were most extensively populated. The upper left quadrant, which shows topics that are rarely investigated, but whose development is quite rapid, was occupied by the words “COVID,” “crisis,” and “case.” These three words seem to have developed rapidly, with high density but low centrality. Therefore, these three topics are experiencing developments in research on COVID-19 and Islamic finance.

The lower right quadrant, which contains basic topic with low centrality but high density, was occupied by words such as “approach,” “global,” “COVID,” and “food.” These words were widely used, although the level of development was not as high as for concepts in the upper left quadrant; nonetheless, the high quantity of these terms indicates that these themes can continue to be developed through further studies to address existing research gaps and to provide more comprehensive insights.

An interesting finding of the thematic map was that the topic “food” occupied part of the lower right quadrant and part of the upper right. Since the upper right quadrant corresponds to high density and centrality, it can be concluded that the “food” topic was widely used and that it developed quite rapidly, it can be seen that the topic of “food” is widely used and is growing quite rapidly, this shows that many papers are examining the relationship between food and COVID-19, especially when considering the importance of health with nutritious and hygienic foods.

Apart from being able to see these keywords in the word cloud and thematic map, the conceptual structure map placed each word based on its Dim 1 and Dim 2 values. Two large clusters emerged, showing connections between the words used in the research on the theme of COVID-19 and Islamic finance. In this map, several popular keywords are included in the red cluster, including the three most popular keywords based on the word cloud (namely “COVID,” “food,” and “pandemic”).

Limitation: This study has several limitations. First, it only focused on articles published on the theme of COVID-19 and Islamic finance, as analyzed through a three fields plot that describes the relationship between journals, authors, and the topics used, an analysis of source impact that identified the most influential journals, and the most popular keywords, as shown in the word cloud, thematic map and conceptual structure map.

Other topics that could be explored include the names of the most popular authors on this topic, the most productive or commonly analyzed countries in this research area, the most productive institutions, and so on. The collection of articles was obtained from the Dimensions database and was limited to August 27, 2020, meaning that changes and developments may continue in the future. Suggestions for further research are to conduct a more complete bibliometric analysis with more elements in order to produce more comprehensive results.

Conclusion: The number of articles on the theme of COVID-19 and Islamic finance published by digital object identifier–equipped journals is quite large, and has the potential to continue growing, given the ongoing spread of the pandemic and the increasing importance of Islamic finance. Several topics and keywords were popularly used in this theme and have the potential for further development, especially in specific domains in Islamic finance in the face of this pandemic. In addition, some of the most productive journals and authors can also be used as references for researchers working on this topic. Thus, it is necessary to encourage Islamic scholars to contribute to research on COVID-19 and to integrate that knowledge into Islamic finance practice.

Notes

Conflict of Interest

No potential conflict of interest relevant to this article was reported.

Funding

The author received no financial support for this article.

Data Availability

Data are available from the author upon reasonable request.

Dataset 1. Raw data collected from Dimensions with search terms were “COVID” AND “Islamic finance.”